Award-winning PDF software

Nj W 9 2025 Form: What You Should Know

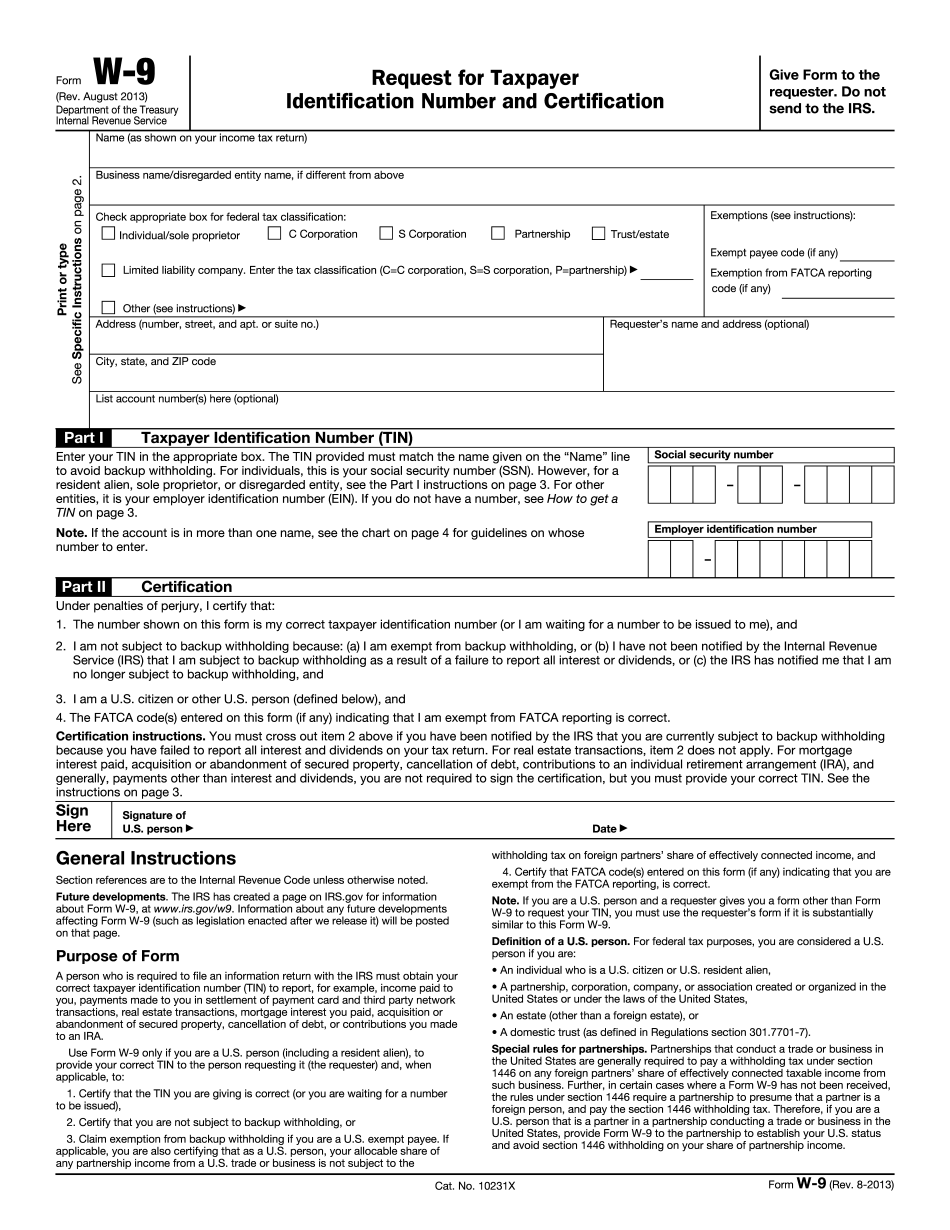

The W-9 may be filled online using a computer or by hand or with an official IRS tax preparer. The forms are also filled upon request, by telephone), facsimile or e-mail. The form is also submitted to the appropriate office, if not previously filled. All fields are required to be filled. If a blank field is entered, the page must be repeated for the required information. Form W-9 may be completed, but the applicant must have adequate money to cover the filing fee, all necessary paperwork necessary and proof that the person filing the W-9 has sufficient funds. The request is not approved if it is submitted without sufficient funds. If the IRS determines that the applicant does not have enough money to make the required submissions, the W-9 application may be rejected. If the applicant makes a payment, he or she must pay in full prior to being allowed access to his or her tax information. If the applicant does not make a payment, the request cannot be processed. Failure to pay will result in the rejection of the application. The applicant is considered to have sufficient funds to pay if the check has not bounced, the applicant has made three or more payments, and the applicant has the following information with which to file the tax return: 1. A recent bank statement, certified or nationally recognized as a government document, that has a balance from the date payment was made. 2. A recent payment receipt, if made with a debit or credit card that does not charge a transaction fee. 3. A receipt from one or more banks or other financial institutions showing the date and amount of the payment. 4. A receipt from a credit or debit card company that has issued or will issue a payment receipt showing the amount credited or debited to the person's account. If the applicant shows all the foregoing information, the application will be processed. The date is shown in the Federal Fiscal Year of filing. For the tax year, the term, Federal Fiscal Year, is a calendar year that begins on October 1st and ends on September 30th. For each subsequent tax year the period begins on the first day of the month in which the last day of the prior year ended and ends on the first day of the month in which the new calendar year begins.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS W-9 2013, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS W-9 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS W-9 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS W-9 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.