Award-winning PDF software

IRS W-9 2025 for Suffolk New York: What You Should Know

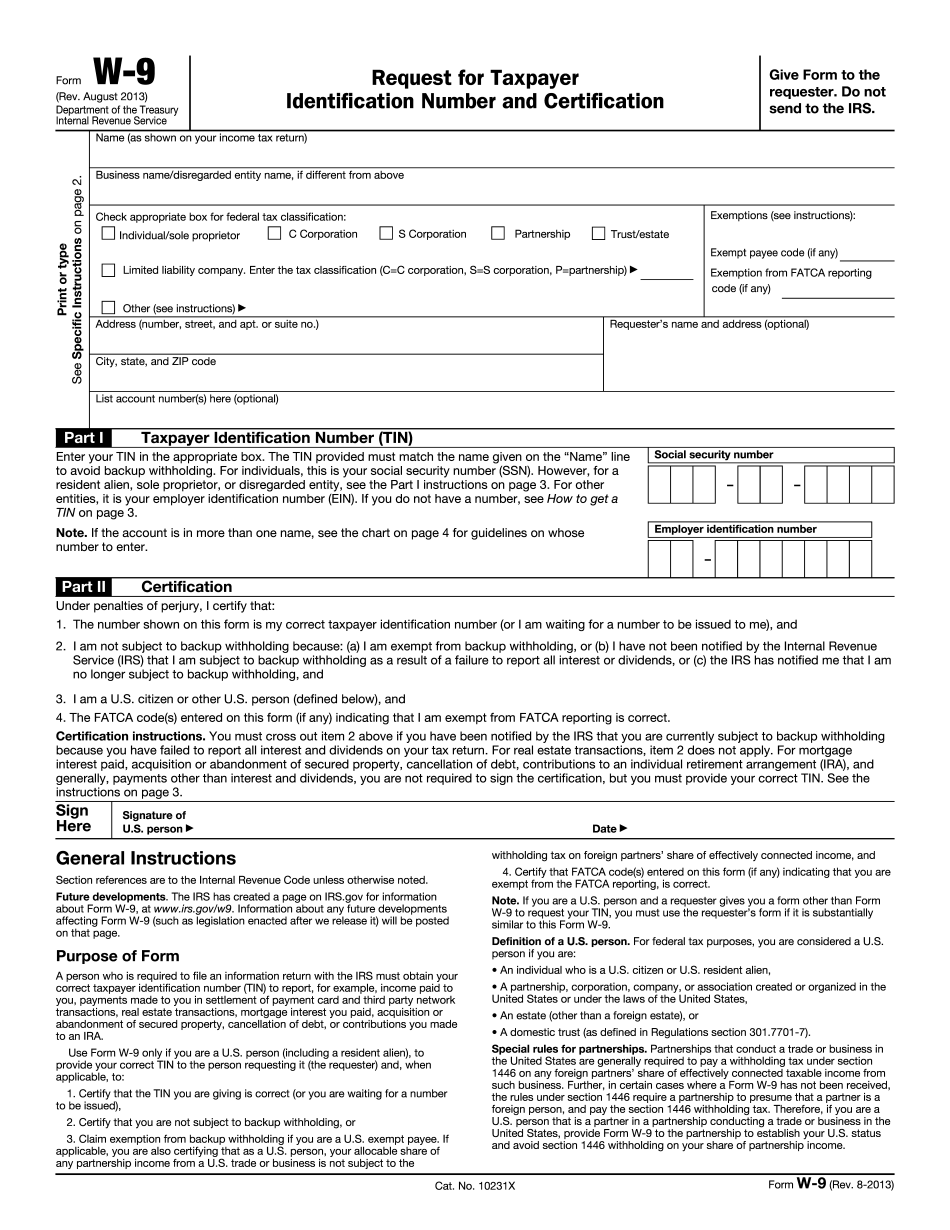

The 10869-T, which has the same purpose, will continue to exist until December 31, 2022. If you have not received the TIN, check back for an update. If you received an TIN, but it has not been updated, click here to review instructions. Apr 6, 2025 — Beginning April 6, 2022, there will be no filing requirement until the expiration of the TIN. If you have not received the TIN, check back for an update. If you have received an TIN, but it has not been updated, click here to review instructions. For more information call. All credits and deductions on tax slips issued since January 1, 2021, that have the word “Tax Paid” on them. All refunds issued from January 1, 2021, to the date the recipient receives a tax slip are included in all tax slips issued on or after that date. All tax slips that have the word “Tax Paid” on them, but the recipient no longer claims a tax deduction on the slips, are returned to sender. All tax slips issued since December 31, 2021, except for slips issued to individuals who have not filed their 2025 tax return, those for whom withholding allowances have been paid and those whose returns have been accepted. All refunds, except those issued to individuals who have not filed their previous 2025 tax return. Apr 6, 2025 — A check is made payable to “Suffolk County Community College.” The check is made payable to Suffolk County, but all check amounts are paid to Suffolk County Community College. If you have a valid, valid NYS tax slip which has all the information you require, you are asked to scan or photocopy it if you must send it to you by mail. Apr 5, 2025 — Tax slips issued since May 1, 2025 are no longer required to be filed, but you are still asked to complete a taxpayer identification number (TIN) and filing instructions. April 1, 2025 — Individuals who have not previously been issued a TIN may be asked to provide one. The application and fee are provided on the back of the form or by a telephone message. March 25, 2025 — Exemptions are eliminated.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete IRS W-9 2025 for Suffolk New York, keep away from glitches and furnish it inside a timely method:

How to complete a IRS W-9 2025 for Suffolk New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your IRS W-9 2025 for Suffolk New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your IRS W-9 2025 for Suffolk New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.